Financial services shoulder the responsibility of managing key resources and making critical decisions for their clients, with data security and customer satisfaction as paramount concerns.

Whether you are a wealth management firm, bank, or insurance company, the right CRM can help you become a more customer-oriented business delivering reliable financial solutions.

| Software | Best For | Pricing |

|---|---|---|

| BIGContacts | Contact Management & Email Marketing Automation | Forever free plan for startups with all premium features. Paid plan starts at $9.99/month. |

| Creatio | Workflow Automation | Starts at $25/user/month. |

| Wealthbox | Financial Advisors | Starts at $45/user/month. |

| AdvisorEngine | Data Visualization | $65/user/month. |

| Ugru CRM | Financial Planning | Starts at $59/month for 3 users. |

| Redtail CRM | Collaborative CRM | Starts at $39/user/month for up to 5 users. |

| Salesforce | Large-Scale Financial Organizations | Starts at $300/user/month. |

List of the 7 Best CRM Software for Financial Services

In my selection process, I considered various factors important for the financial industry, such as the specific features, the ease of use and integration, the price and value, and the security and compliance of the CRM. I also took into account my personal experience with the tools and recommendations from industry peers who have used them successfully.

1. BIGContacts– Best for contact management & email marketing for small & medium businesses

As a CRM expert, I can confidently say that BIGContacts does the heavy lifting when it comes to managing all aspects of financial services. It is a reliable CRM tool designed to streamline and automate workflows while ensuring personalized interactions with customers.

This contact management software for financial service providers helps earn clients’ trust and turn potential customers into long-term affiliates.

It offers a centralized 360-degree view of all your clients’ account details, including assets, transactions, financial documents, and communication history, creating a clutter-free database that only includes the most relevant information for easy and quick access.

Another aspect that I find impressive is the ability to create personalized drip email campaigns. Plus, tracking the performance of these campaigns is extremely easy with the help of customizable report templates and advanced email analytics.

What You’ll Like:

- Powerful task and workflow automation capabilities that take care of repetitive tasks allowing you to focus on building meaningful relationships

- Strict data security models, user roles, two-factor authentication, and GDPR compliance ensure all your information is safe and protected

- Native integration with Quickbooks to track all transactions from within the contact records

- Effective customer segmentation to predict clients’ needs and provide relevant solutions

- Enhances team collaboration and encourage sharing of task and files on the go with mobile CRM

What You May Not Like:

- When working with large datasets requires an extremely stable internet connection

- Frequent software updates warrant constant adaptation from users

Pricing:

- Forever free plan for startups with all premium features.

- Paid plan starts at $9.99/month.

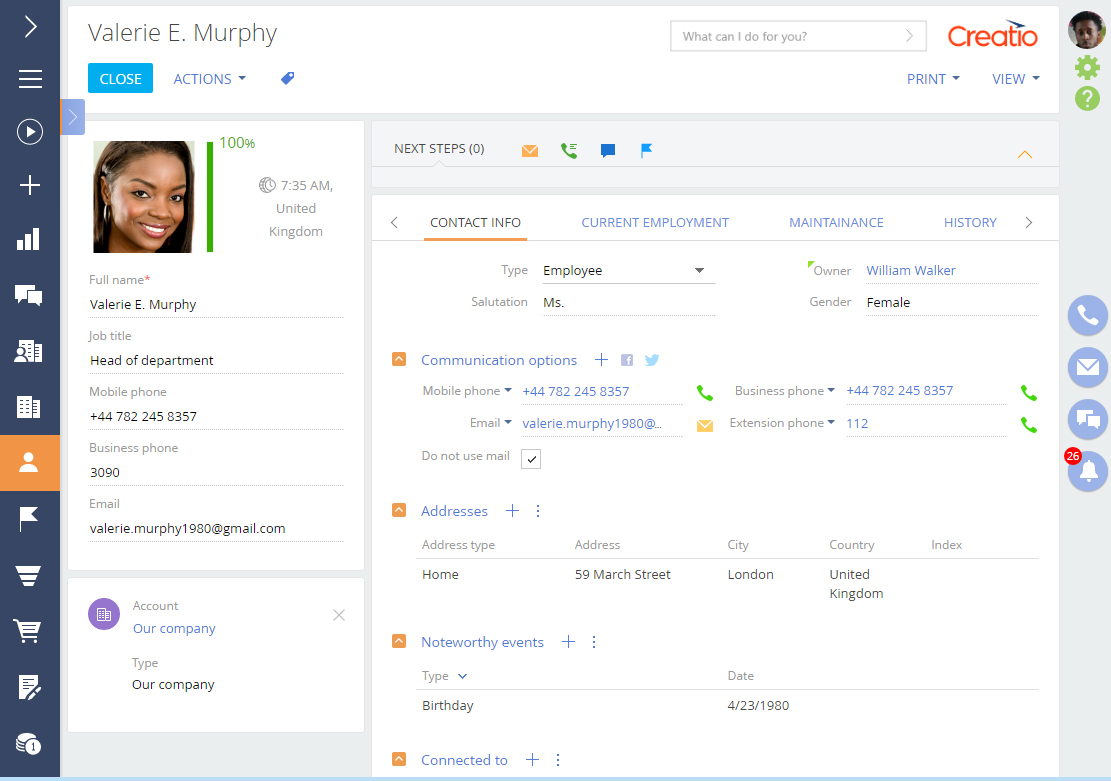

2. Creatio– Best for no-code automation

Image Source: Creatio

For financial services looking for a no-code platform to automate their day-to-day operations, one of my top recommendations would be Creatio.

This highly adaptable CRM software helps financial organizations to become agile through a unified low-code platform for process management and CRM. It offers a far-reaching solution that brings together customer data, automates processes, and assists in decision-making.

I was impressed with the tool’s ability to craft and manage multichannel marketing campaigns. Not just that, the tool makes it easy to manage your sales pipeline, identify areas for improvement, and enhance the overall customer experience.

What You’ll Like:

- A low-code platform that’s easily customizable, even by users with little coding experience

- A predictive scoring tool to assist with credit decision-making

- Access to real-time KPI monitoring, reporting, and analytics

- A unified platform for sales, marketing, and service teams to promote better collaboration

- Tools for document management and end-to-end sales processes.

What You May Not Like:

- Performance can be laggy when working with larger databases

- Creation of online forms requires HTML knowledge

Pricing:

- Starts at $25/user/month.

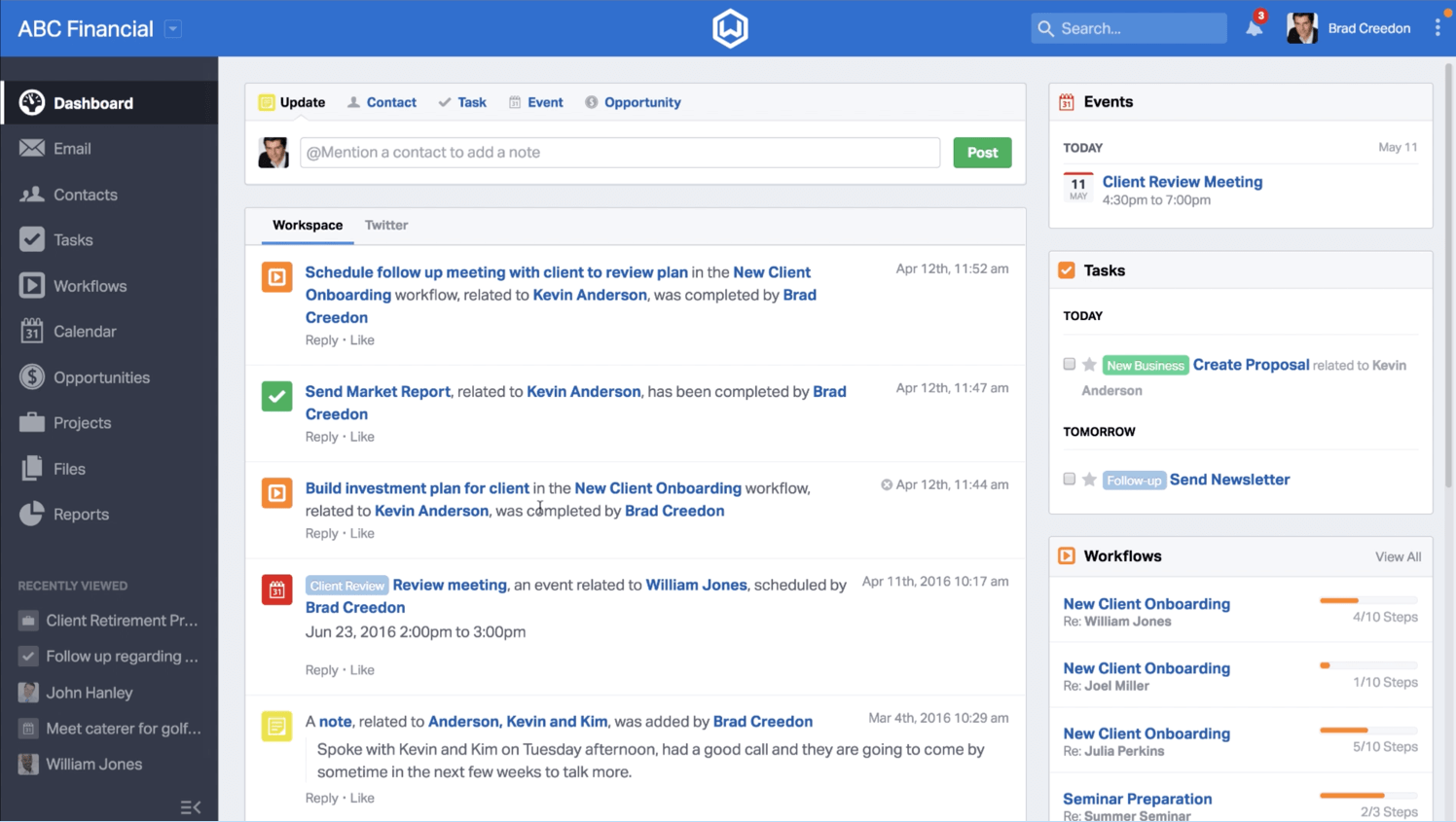

3. Wealthbox– Best for Financial Service Providers

Image Source: Wealthbox

If you are a financial service provider and in need of a comprehensive tool that simplifies your daily workflow, I would suggest you give Wealthbox a go.

It’s a platform that manages extensive client information, updates advisors on important events, and integrates smoothly with other essential tools. You will find the user-friendly interface of this CRM for wealth managers to be far and wide useful for effectively navigating through client profiles.

I also found the social media activity tracking, client segmentation, and click-to-call functionality to be extremely valuable for building stronger relationships.

What You’ll Like:

- Detailed contact record pages that display all calls, emails, files, and transactions

- Effective contact management features such as custom fields, contact tags, groups, filters, and more

- Integration with several financial planning and portfolio management software

- Real-time streaming updates on client activity

- Strong task and event tracking features to manage the full client lifecycle

What You May Not Like:

- No built-in billing or invoicing tools

- Email templates and design options are limited

Pricing:

- Starts at $45/user/month.

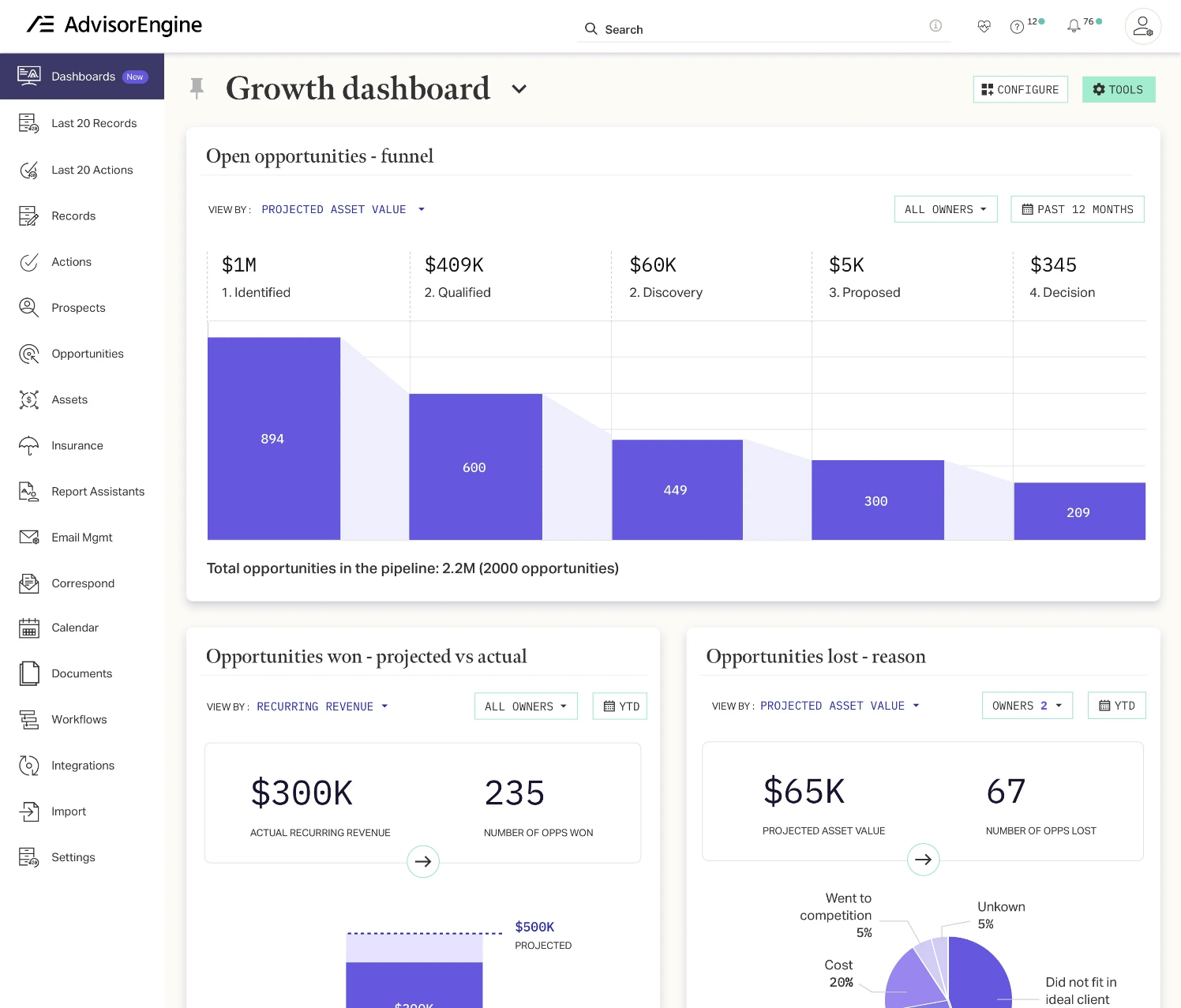

4. AdvisorEngine CRM – Best for Data Visualization

Image Source: AdvisorEngine CRM

What especially stood out to me about AdvisorEngine CRM is its ability to create comprehensive dashboards that make it easy to track results and improve performance.

I also liked the user management capabilities of this tool – making it easier to manage operations and permissions across the organization.

Onboardings, portfolio constructions, billing – AdvisorEngine streamlines it all in one place.

It transforms the way financial services operate by providing a smart, digital, and intuitive interface where they can manage client portfolios, streamline compliance workflow, and automate operations.

What You’ll Like:

- Strong workflow engine to automate routine tasks

- Segment users across the organization with the help of groups

- Capture information from website visitors with the help of custom forms

- Custom reports can be deployed or scheduled effortlessly

- Portfolio rebalancing tools integrated into the platform

What You May Not Like:

- On the more expensive side compared to other CRM tools

- The user interface may require some time to get familiar to

Pricing:

- $65/user/month.

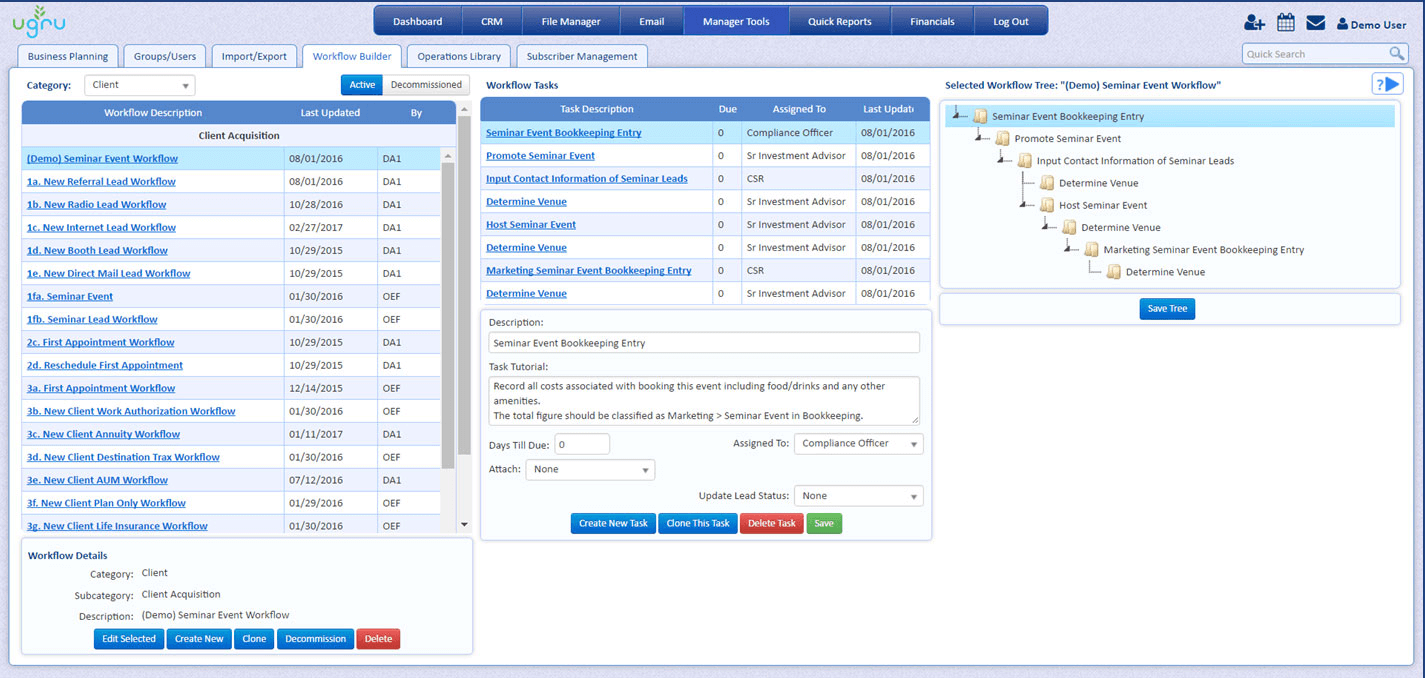

5. UGRU CRM – Best for Financial Planning

Image Source: UGRU CRM

UGRU CRM is an all-in-one suite designed to skyrocket the growth of financial services.

It is intended to give financial professionals full control over their business, allowing them to optimize efficiency, compliance, and profitability. With a built-in financial dashboard and features like sales forecasting, UGRU CRM simplifies the financial planning process.

You will also find superior features like an advanced fact finder, lead management, communication tracking, client portal, and more. Additionally, the powerful sales and marketing automation capabilities of this CRM for financial planning make it a highly popular solution.

What You’ll Like:

- Advanced financial planning tools included in the platform

- Marketing capabilities such as mass email campaigns, a native email application, campaign analytics, etc.

- Client portal for easy client interaction and collaboration

- Useful workflow automation to streamline operations

- Strong compliance features that ensure client services are professional and legally sound

What You May Not Like:

- The learning curve can be steep for non-technical users

- The software can experience occasional glitches

Pricing:

- Starts at $59/month for 3 users.

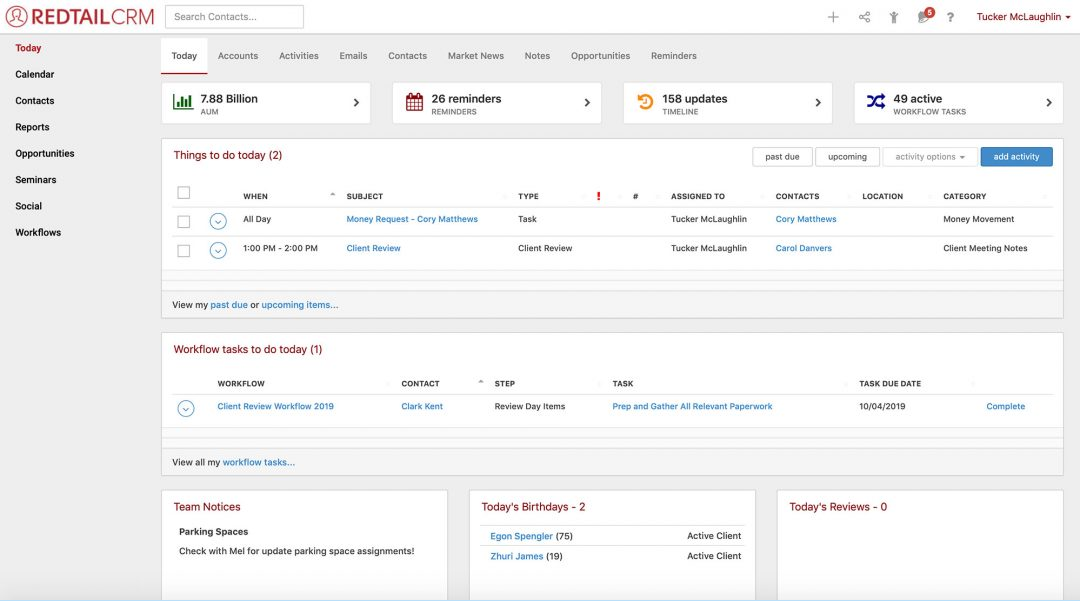

6. Redtail CRM – Best for Collaborative CRM

Image Source: Redtail CRM

Distinguished as one of the most competent CRMs in the financial sector, Redtail CRM aims to manage client information and improve team collaboration.

With a focus on client management, activity tracking, and detailed reporting, Redtail CRM provides a platform for collaborative teamwork while ensuring top-tier client servicing.

This CRM platform features advanced workflow automation, ensuring accountability and preventing important tasks from falling through the cracks. Its extensive integration capability facilitates seamless data exchange with various financial tools, avoiding data redundancy.

What You’ll Like:

- Easy data migration from other popular CRMs

- Strong reporting capabilities to derive meaningful insights from your client data

- Offers an intuitive mobile app for working on the go

- Excellent for team collaboration with options for task assignment and team broadcasts

- Improves operational efficiency with note-taking, client interaction tracking, sales pipeline management, and two-way sync with Office365 and Google

What You May Not Like:

- The user interface may seem a bit outdated

- The contact search function can use improvement

Pricing:

- Starts at $39/user/month for up to 5 users.

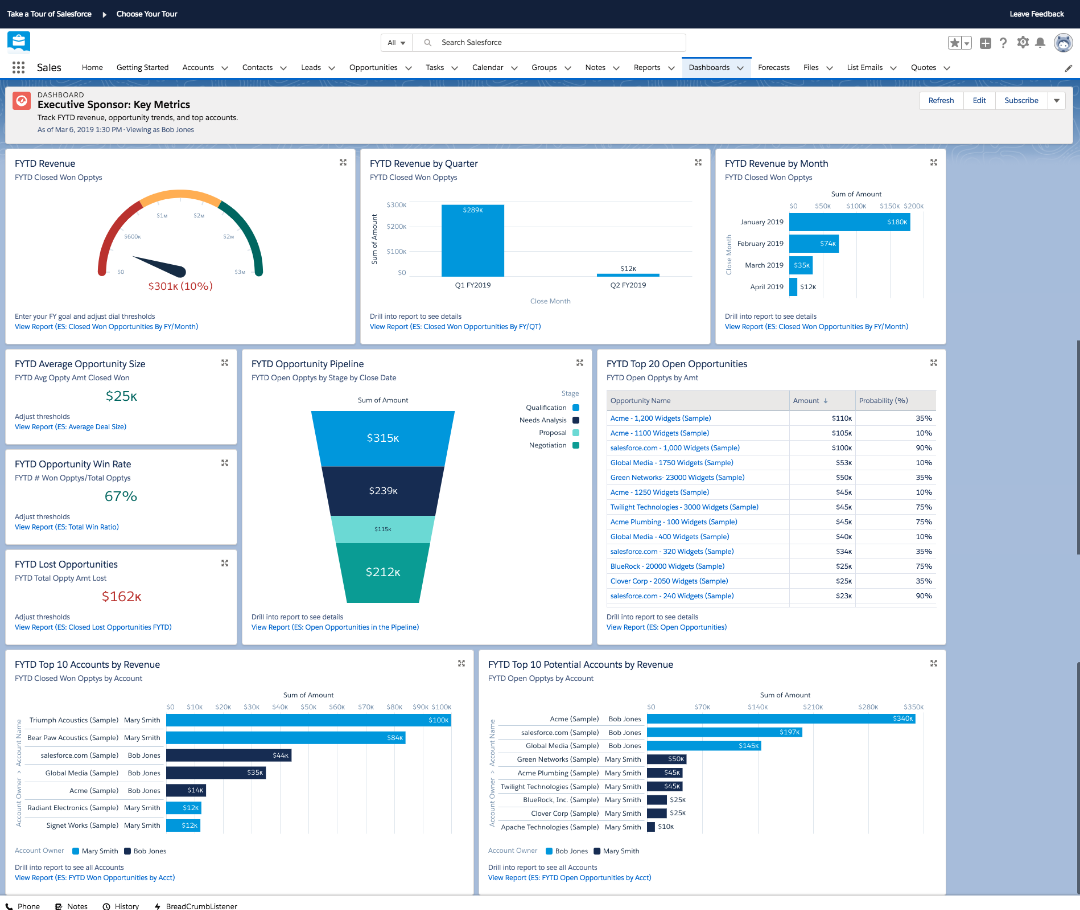

7. Salesforce – Best for large and complex sales organizations

Image Source: Salesforce AppExchange

Salesforce is an industry titan in the CRM sphere.

Why? Because it offers a personalized and integrated suite equipped to help enterprise-level financial services providers grow, innovate, and become command centers for their customers.

I like that it empowers you to effectively manage client relationships at scale, providing a 360-degree view of each client. This isn’t just about storing contact information or financial history but enriching every interaction and providing a connected experience with in-depth insights.

You can easily schedule appointments, collaborate with team members, and even identify new business opportunities – all within this user-friendly CRM wealth management platform.

What You’ll Like:

- Highly customizable with a powerful application marketplace (AppExchange)

- In-depth data analysis and decision-making tools for understanding client patterns and making better predictions

- Extensive integration capabilities with other systems, including email and social media

- Capabilities for handling high volumes of data efficiently

- Comprehensive mobile functionality for on-the-go work

What You May Not Like:

- Steep learning curve, especially for non-tech-savvy users

- High cost, especially for small and mid-sized businesses

Pricing:

- Starts at $300/user/month.

Which is the Best CRM for Financial Services?

After evaluating the wide range of CRMs for financial services, I can confidently recommend the following three options, each catering to unique use cases:

Option A: BIGContacts

BIGContacts is a remarkable CRM system offering exceptional contact management features. Plus, its automation capabilities help save time and boost productivity. What sets BIGContacts apart are its robust data security mechanisms to protect sensitive client information, efficient customer segmentation, and collaboration-enhancing features.

Option B: Wealthbox

Wealthbox caters specifically to financial planners who require potent tools to manage client relationships. Its user-friendly interface, coupled with real-time updates on client activity, makes it an excellent choice for financial planners.

Option C: UGRU CRM

For financial professionals planning to scale their business and require an all-encompassing solution, Ugru CRM is an ideal candidate. It offers advanced finance planning and automation in sales and marketing operations, among other unique features.

Evaluation Criteria

The evaluation of products or tools chosen for this article follows an unbiased, systematic approach that ensures a fair, insightful, and well-rounded review. This method employs six key factors:

- User Reviews / Ratings– Direct experiences from users, including ratings and feedback from reputable sites, provide a ground-level perspective. This feedback is critical in understanding overall satisfaction and potential problems.

- Essential Features & Functionality: The value of a product is ascertained by its core features and overall functionality. Through an in-depth exploration of these aspects, the practical usefulness and effectiveness of the tools are carefully evaluated.

- Ease of Use: The user-friendliness of a product or service is assessed, focusing on the design, interface, and navigation. This ensures a positive experience for users of all levels of expertise.

- Customer Support: The quality of customer support is examined, taking into account its efficiency and how well it supports users in different phases – setting up, addressing concerns, and resolving operational issues.

- Value for Money: Value for money is evaluated by comparing the quality, performance, and features. The goal is to help the reader understand whether they would be getting their money’s worth.

- Personal Experience/Expert’s Opinion: This part of the evaluation criteria draws insightful observations from the personal experience of the writer and the opinions of industry experts.

FAQ

What are the benefits and features of a CRM for wealth management?

A CRM for wealth management provides benefits such as streamlined client communication, automated workflows, enhanced reporting capabilities, and improved client data management. The key features generally include contact management, portfolio management, task management, comprehensive analytics, and integration with other financial software.

How do financial CRMs help clients?

Client management solution for financial advisors enhances the client experience by ensuring personalized, timely, and efficient service. It aids in delivering tailor-made financial plans, facilitates smooth communication, and provides clients with easy access to their portfolios and financial progress.

How to choose the best CRM for financial services?

To choose the best CRM, consider factors like ease of use, cost-effectiveness, integrations, scalability, customization options, and the quality of customer support. Another critical feature of financial CRMs is compliance with data regulations. Therefore, you must choose GDPR and CCPA-compliant software to avoid legal consequences and ensure data security.

For more details, watch:

What are the expected costs of a CRM for financial services?

The cost of a CRM for financial advisors can vary extensively based on factors such as the number of users, complexity, required features, and the service provider. Typically, the costs can start from as low as $5/user/month to upwards of $1000 per month for advanced and comprehensive systems.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!