Do you spend nearly half your workweek buried in paperwork instead of helping clients? I’ve seen this first-hand working alongside financial advisors, and it’s frustrating.

A recent J.D. Power study found that about 28% of advisors don’t have enough time for clients because they spend 41% more time on compliance and admin tasks than their peers.

That’s exactly why having the right CRM for financial advisors is so important. A good CRM doesn’t just store data – it acts like your assistant, reminding you of follow-ups, organizing client info, integrating with your other tools, and keeping compliance in check so you can focus on clients.

In this guide, I’ll cover the 10 best CRM software for financial advisors in 2026, with an honest look at how each one helps solve real advisor problems like client onboarding, compliance headaches, and keeping every interaction organized.

10 Best CRM for Financial Advisors in 2026

When you’re short on time, this quick comparison chart lets you see which CRM might fit your needs. Below is a side-by-side look at what each tool does best, its starting price, and notable features (like AI or compliance tools) that stand out this year.

| CRM Tool | Best For | Pricing |

|---|---|---|

| BIGContacts | Contact Management & Email Marketing | Free for small teams. Paid plan starts at $9.99/month |

| Redtail CRM | Industry-specific features & integrations | Starts at $45/user/month |

| Wealthbox CRM | Ease of use & modern interface | Starts at $59/user/month |

| Salesforce Financial Services Cloud | Enterprise analytics & customization | Starts at $325/user/month |

| Zoho CRM | Affordability & customization | Starts at $20/user/month |

| PractiFI | Compliance & referral pipeline management | Starts at $120/user/month |

| Junxure | Performance reporting & workflows | Starts at $65/user/month |

| Act CRM (Act4Advisors) | Marketing automation | Starts at $30/user/month |

| Money Advice + CRM | Client data capture & financial tools | Custom pricing |

| eWay-CRM | Outlook-based CRM integration | Starts at $18/user/month |

1. BIGContacts – Best for Contact Management & Email Marketing for Growing Businesses

I’ve used BIGContacts in my own financial advisory setup, and the first thing that stood out was how effortless it was to keep all client records in one place. Instead of flipping between spreadsheets and email threads, I had a single clean dashboard showing recent interactions, client notes, and upcoming tasks.

What really made a difference for me was its email marketing capability. I was able to send targeted updates to client segments – for example, separate email newsletters for “retirement planning clients” vs. “young families” – without worrying about any daily sending limits.

I also appreciated the integrations available. BIGContacts synced with tools like QuickBooks, so during client meetings I could pull up invoice or transaction history without switching apps. This made my prep work much smoother and helped me give more personalized advice faster.

Pros:

- Easily capture, manage, and segment contacts with lists, tags, and grouping options.

- Allows task allocation to team members, schedules reminders, and sets up alerts to keep everyone on track.

- Web form integration helps collect leads and their relevant information effortlessly.

- Easily adjust the sales pipeline with a customizable, drag-and-drop interface.

Cons:

- No downloadable or on-premise version.

- Dark user interface option not available.

User Ratings: 4.5/5

Pricing:

Free for small teams. Paid plan starts at $9.99/month.

Here’s what Sennin Quigley from the Foundation for Financial Education (F3E) has to say about his experience using BIGContacts:

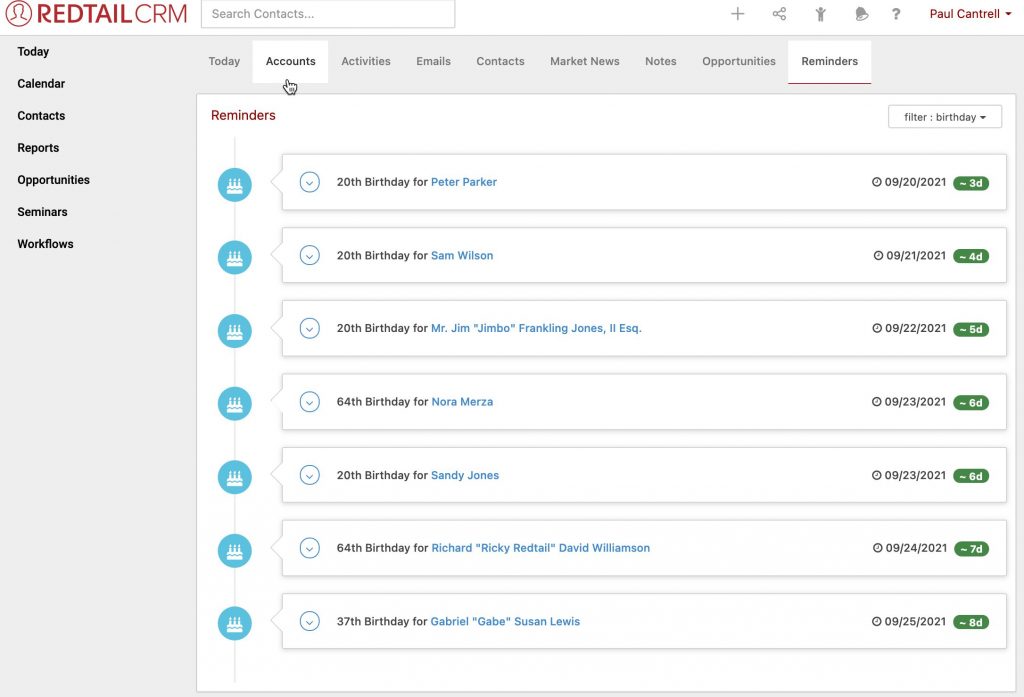

2. Redtail CRM – Best for Industry-Specific Features & Integrations

Redtail Technology

In my experience with Redtail CRM, I immediately noticed how purpose-built it is for financial advisors. As soon as I logged in, I saw fields for client birthdates, investment objectives, and risk tolerance already baked into the system – no heavy customization needed.

Another area where Redtail shines is integrations. It connects with a ton of other tools financial advisors use. I also loved the seminar management tool – when I hosted a client webinar, Redtail helped track the invites and follow-ups in one place.

On the usability front, Redtail offers a friendly interface that doesn’t require much training. The learning curve was short, and there are plenty of support resources (they provide webinars, video tutorials, and a responsive help desk).

Pros:

- Purpose-built for financial advisors with pre-set fields and workflows

- Offers unlimited contacts, tasks, and even broadcast emails for marketing campaigns

- Extensive integration ecosystem – connects with portfolio management, financial planning, and custodian platforms seamlessly.

- Free mobile app for on-the-go access; lots of training and support available (webinars, tutorials, etc.).

Cons:

- User interface feels a bit dated and not as visually modern as some newer CRMs.

- Some users report the system can get sluggish when handling very large databases.

User Ratings: 4.4/5

Pricing:

Approximately $45–$65 per user/month.

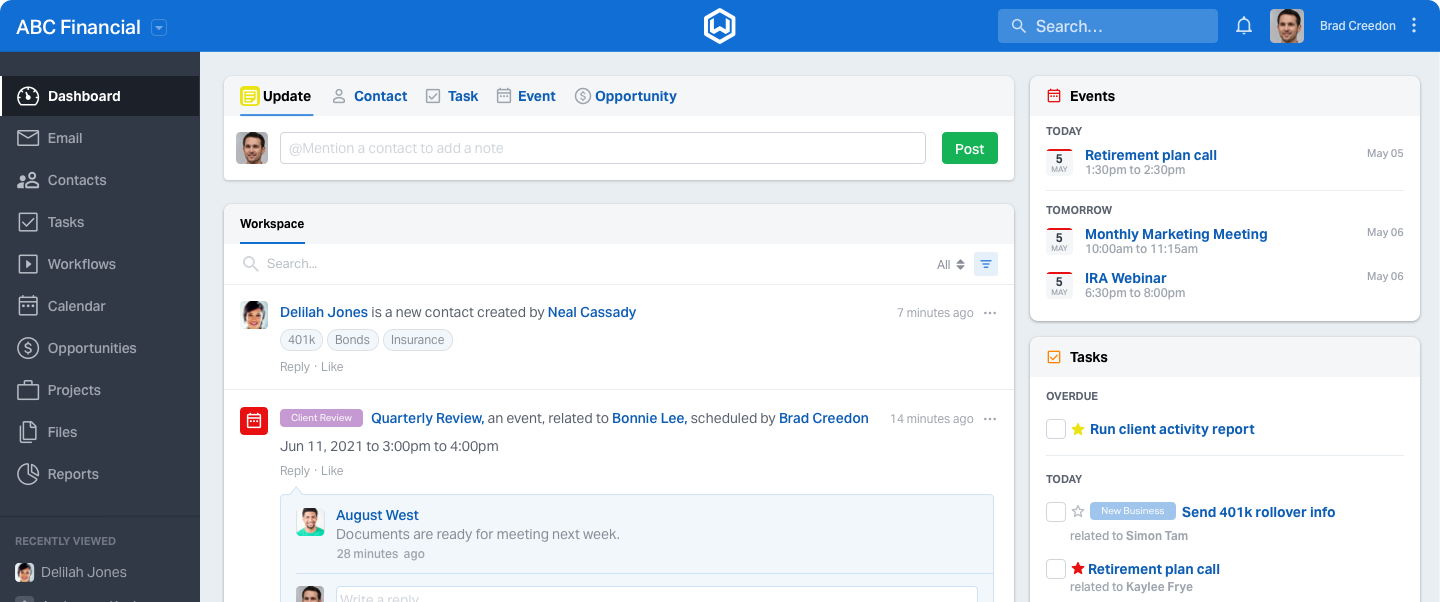

3. Wealthbox CRM – Best for Ease of Use & Modern Interface

Image source: Wealthbox

When I tried Wealthbox CRM, what struck me immediately was its sleek, modern design and how little training it required. Wealthbox feels a lot like a familiar social media feed in some ways: it has an “activity stream” where you see updates on tasks, notes, and emails in a scrolling feed.

Another big highlight of Wealthbox is its integration capabilities. It connects with over 100 other apps advisors use, from risk profiling tools to email marketing software. Security and compliance didn’t take a backseat either. Wealthbox has bank-level security – 256-bit encryption, multi-factor authentication – so I felt confident client data was safe.

The only drawback I noticed is that Wealthbox doesn’t (yet) have some of the deep analytics or AI features of bigger CRMs. For example, reporting is solid but fairly straightforward (though they do have customizable reports). And while it’s great for a small or mid-sized firm, extremely large enterprises might find it a bit simplified.

Pros:

- Exceptionally user-friendly interface – minimal training needed for staff.

- Offers a streamlined contact management and drag-and-drop pipeline that’s very easy to navigate

- Integrates with 100+ advisor tools and apps for seamless data flow across your tech stack

- Collaboration-friendly features like shareable client activity streams keep the whole team in the loop

Cons:

- Lacks some advanced features like AI-driven analytics or in-depth marketing automation – it covers the basics well but isn’t as feature-rich as enterprise platforms

- Fewer built-in portfolio reporting tools compared to specialized CRMs (you’d integrate a separate portfolio system for that)

User Ratings: 4.5/5

Pricing:

Starts at $59 per user/month.

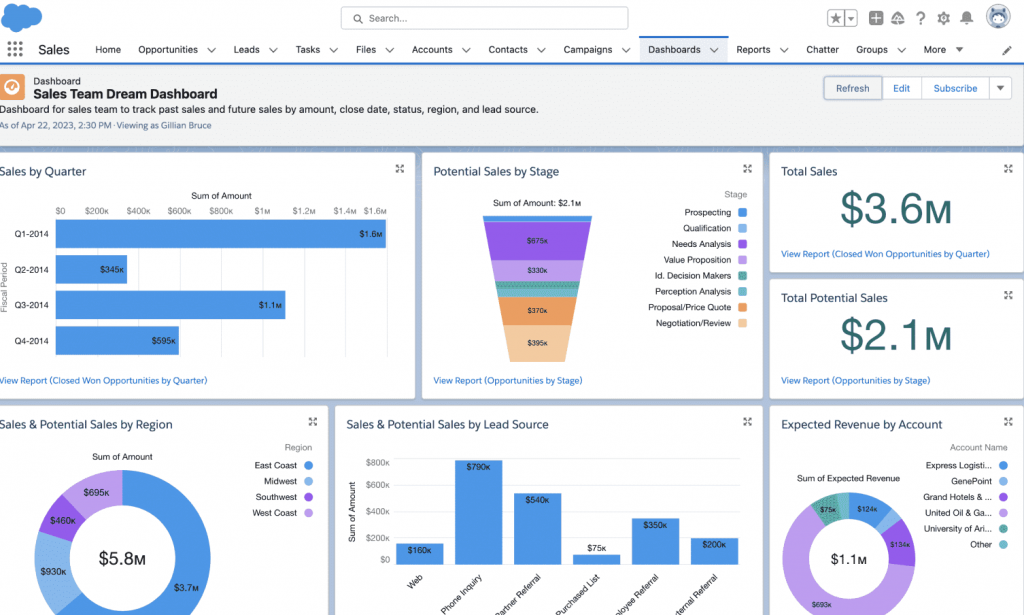

4. Salesforce Financial Services Cloud – Best for Enterprise Analytics & Customization

Image Source: Salesforce

Right out of the box, Salesforce FSC gave me a taste of its AI and analytics capabilities. For example, it has Einstein AI analytics that can comb through client data and highlight patterns – like flagging if a client might be ready for a new product based on their behavior.

It also provided intelligent lead scoring, which was interesting: it analyzes prospect engagement and helps predict who’s likely to become a client. Salesforce is also highly customizable. I was able to tailor data fields, page layouts, and even automate complex workflows, but to be honest, I leaned on a consultant friend to help with the heavy lifting.

Another strong point: integrations and ecosystem. Salesforce probably has the widest integration network of any CRM, through its AppExchange. I connected it to my Outlook email, a portfolio management tool, and even a voice transcription service to log call notes – it all worked, since so many vendors build connectors for Salesforce.

Pros:

- Advanced analytics and AI (Einstein) provide predictive insights and automated recommendations from your client data

- Includes wealth management-specific features (householding of clients, financial goal tracking, built-in compliance workflows and disclosure management) out of the box

- Massive integration ecosystem (Salesforce AppExchange) means you can connect to virtually any other software, from portfolio reporting tools to marketing automation.

- Extremely powerful and highly customizable – you can tailor almost every aspect to your firm’s needs

Cons:

- Steep learning curve and setup time; often requires dedicated training or hiring a Salesforce admin/consultant to implement properly

- The abundance of features can be overwhelming, and smaller teams may not utilize everything they’re paying for

User Ratings: 4.4/5

Pricing:

Starts at $325 per user/month.

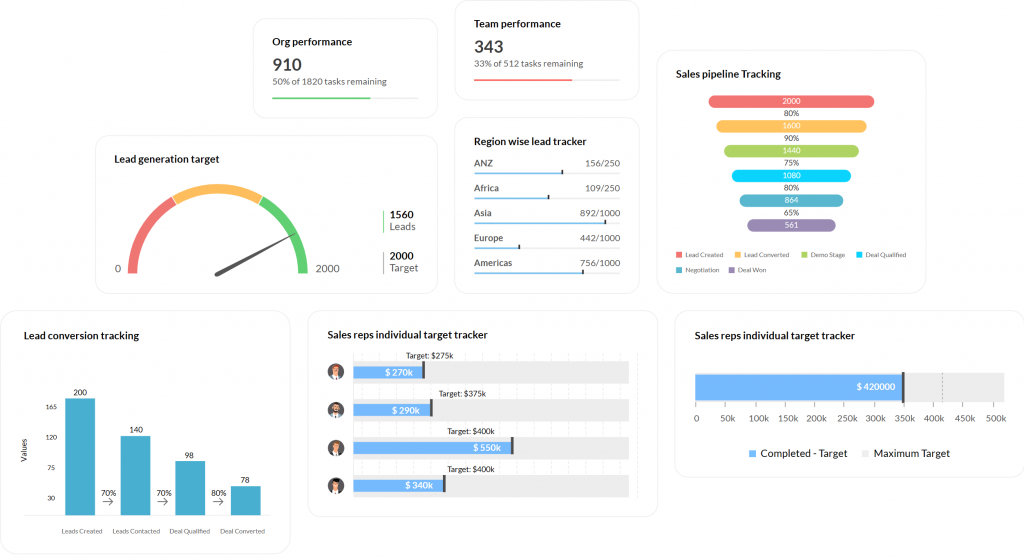

5. Zoho CRM – Best for Affordability & Customization

Image Source: Zoho

I experimented with Zoho CRM to see how it might fit an advisory practice, and I was pleasantly surprised by how much it offers for a relatively low cost. The setup wizard actually had an option to choose “Financial Services” as an industry, which pre-loaded some useful fields. One of Zoho’s coolest features is its AI assistant, Zia. I experimented with Zia and it could do things like suggest the best time to contact a lead (based on past interactions) and even auto-fill some data or make task reminders.

Zoho CRM’s customization is a big plus. I was able to add modules for things like “Investments” and “Accounts” to mirror a mini portfolio view, and I created custom fields for things like risk tolerance and account numbers. Another strength is the broader Zoho ecosystem. Since Zoho offers everything from email marketing to accounting software, the CRM integrates smoothly with those if you choose to use them.

The mobile app was decent too – I could quickly pull up client contact info or log a meeting outcome from my phone. In terms of shortcomings for financial advisors: because Zoho is industry-agnostic, it lacks built-in compliance features like automatic communication archiving.

Pros:

- Strong customization capabilities: you can add custom fields, modules, and workflows to tailor it to financial services.

- Includes AI-powered features like Zia for recommendations, task automation, and forecasting to boost efficiency

- Integrates well with both Zoho’s suite (emails, accounting, etc.) and popular third-party apps (Office 365, Google Workspace, etc.)

- Clean interface and decent mobile app, making daily use convenient

Cons:

- Not a finance-specific CRM, so it lacks built-in industry features (no native portfolio integrations or compliance archiving – you’d need to integrate or DIY)

- Some users report that advanced analytics or reports in Zoho are less effective than higher-end CRMs

User Ratings: 4.1/5

Pricing:

Starts at $20 per user/month.

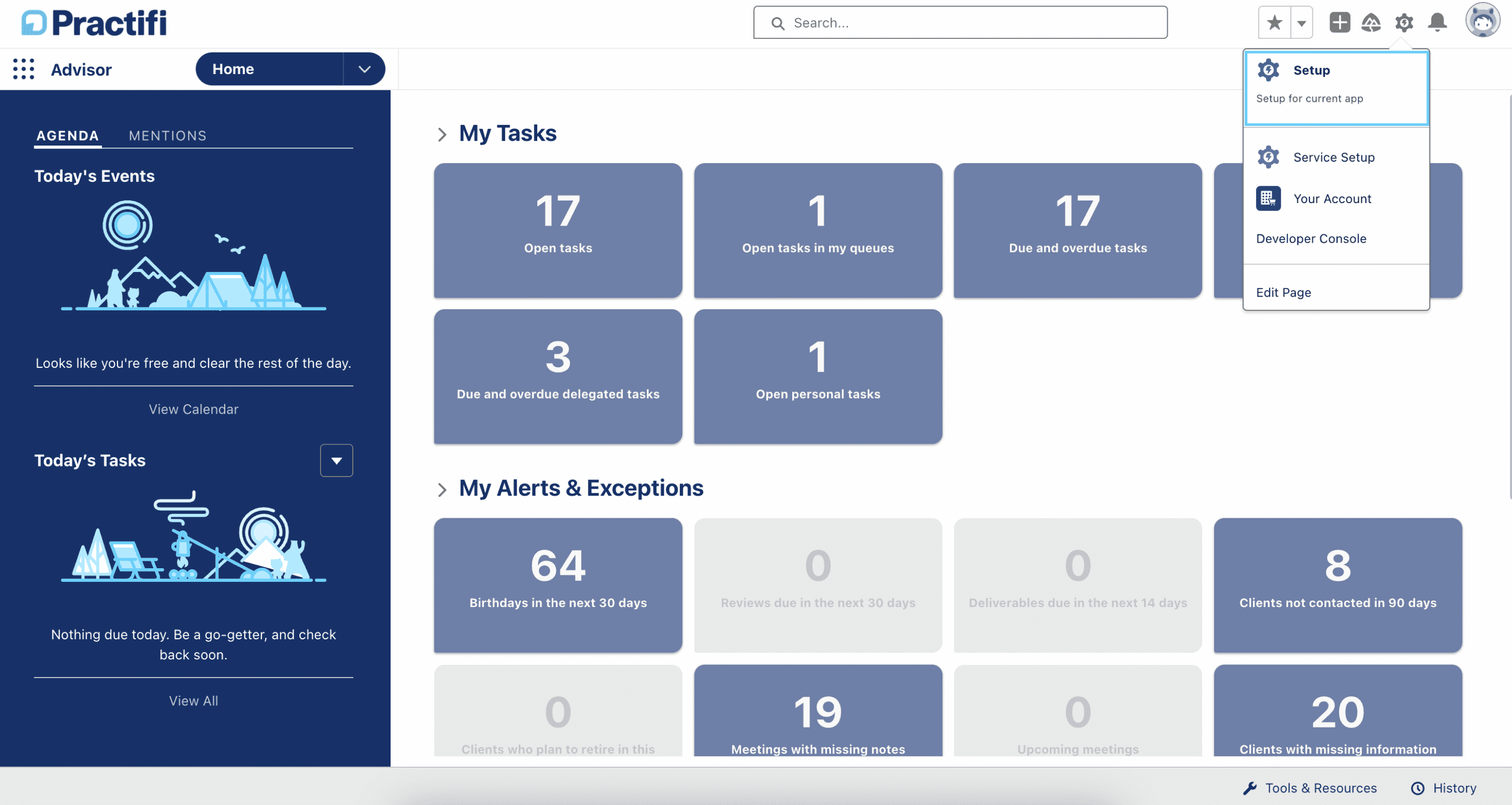

6. PractiFI – Best for Compliance & Referral Pipeline Management

Image Source: PractiFI

I’ve always struggled with compliance requirements, and that’s where PractiFI truly shone. Built on Salesforce, it gave me enterprise-level compliance reporting while still offering user-friendly dashboards.

I liked how it tracked every interaction automatically — emails, meetings, notes — so if I ever needed to present an audit trail, everything was already logged. It also helped me manage my referral networks and Centers of Influence, which is a big part of financial advisory growth.

That said, Salesforce complexity sometimes peeked through, and I found myself needing support for customization. But if compliance is your top concern, PractiFI is hard to beat.

Pros:

- Seamless integration with several third-party applications through the Salesforce ecosystem.

- User-friendly interface simplifies complex Salesforce setup for RIAs (Registered Investment Advisors).

- Automatically tracks events and emails to streamline daily operations.

- Offers a mobile-friendly interface for on-the-go client data management.

Cons:

- Limited availability of internal resources may delay tasks and project completion.

- Technical support might lack in-depth expertise with complex issues.

User Ratings: 4.3/5

Pricing:

Starts at $120/user/month.

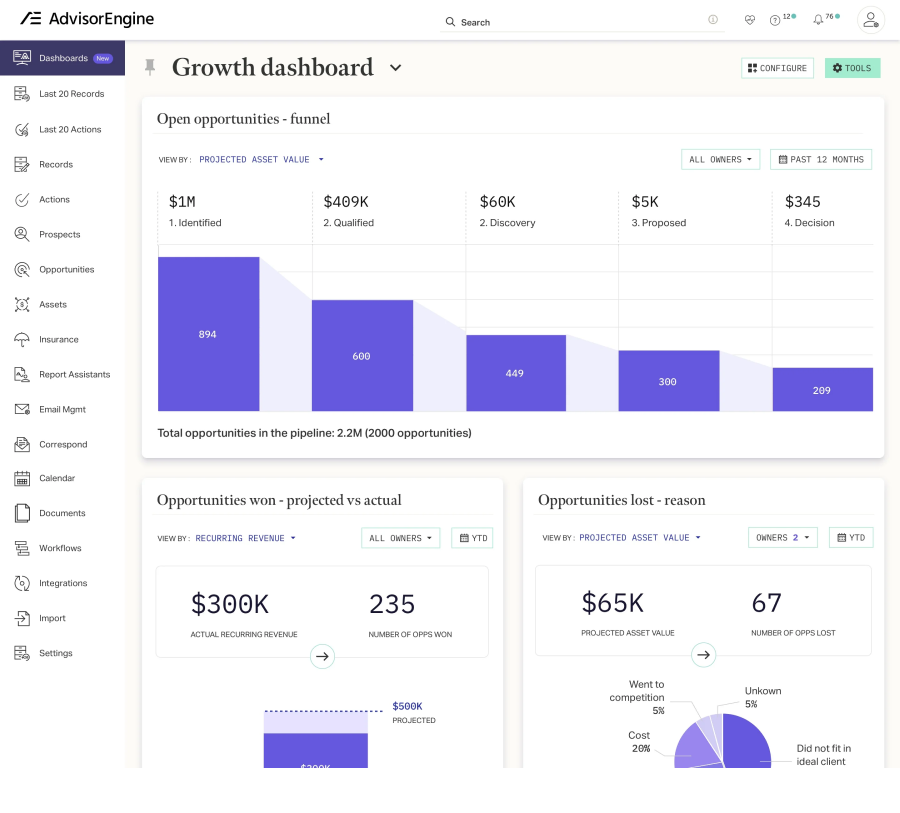

7. Junxure – Best for Performance Reporting & Workflows

Image Source: Junxure

Using Junxure felt like upgrading from a basic CRM to a full wealth management platform. I could centralize client demographics, investment data, and communication history in one system. That gave me a clearer picture of client performance and helped me tailor strategies more effectively.

Its reporting capabilities stood out. I could generate detailed portfolio reports that impressed clients and made compliance audits much less stressful. The automated workflows also meant that I no longer worried about missing follow-ups or deadlines.

My biggest drawback was its clunky navigation — adding detailed information often required multiple clicks. But for advisors focused on long-term client portfolio tracking, Junxure is a strong contender.

Pros:

- Integrates smoothly with Riskalyze, Orion, Schwab, MGP, and Office 365.

- Enables clients to access their investment statements independently.

- Centralized Action Screen manages tasks in one place, improving workflow management.

- Allows flexible access to hire independent contractors, enhancing sales pipeline management.

Cons:

- Data entry requires too many clicks.

- Non-customizable home screen slows workflow.

User Ratings: 4/5

Pricing:

Starts at $65/user/month.

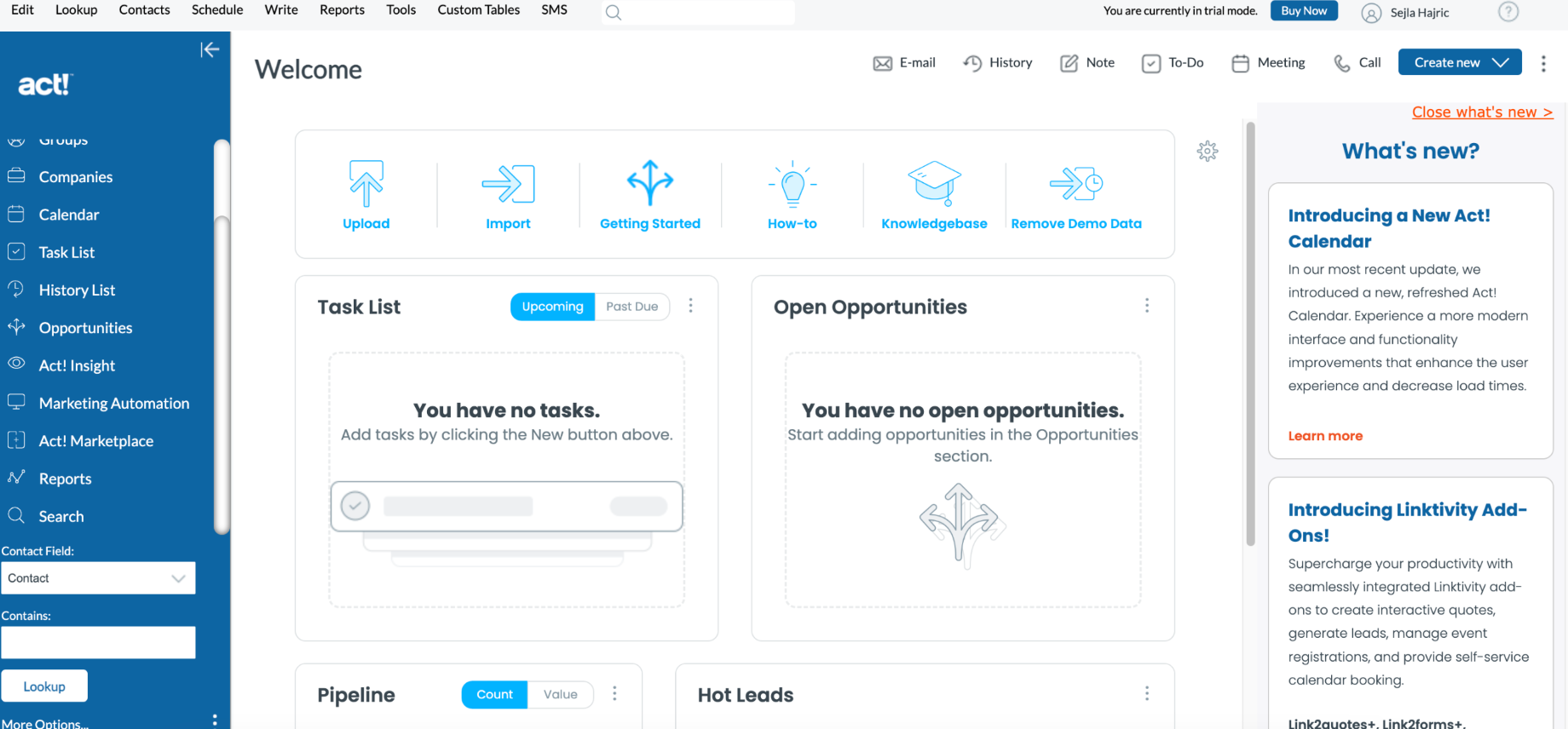

8. Act CRM (with Act4Advisors) – Best for Marketing Automation

Image Source: Act CRM

When I tested Act CRM, I found it particularly strong in automating marketing campaigns. I could segment clients by criteria like portfolio type or investment stage and then send personalized drip campaigns to nurture leads. For a busy advisor, this saved a lot of repetitive work.

The add-on Act4Advisors made the platform even more relevant. It gave me fields tailored for financial data and compliance, which reduced the need for messy customizations. I appreciated how it helped me manage broker interactions alongside direct clients.

That said, the interface felt a little dated, and handling duplicate records was clunky. Still, Act CRM was a reliable choice for advisors focused on marketing efficiency.

Pros:

- Allows real-time team collaboration for teams of up to five members.

- Offers the ease of changing layouts and adding fields to suit specific needs.

- Includes a fax cover feature, which has been highly useful for frequent fax users.

- Provides educational materials like a Training Video Library and Knowledge Base.

Cons:

- Deleting duplicate contacts can be unmanageable, requiring each to be deleted individually.

- Outdated, clunky user interface.

User Ratings: 5/5

Pricing:

Starts at $30/user/month.

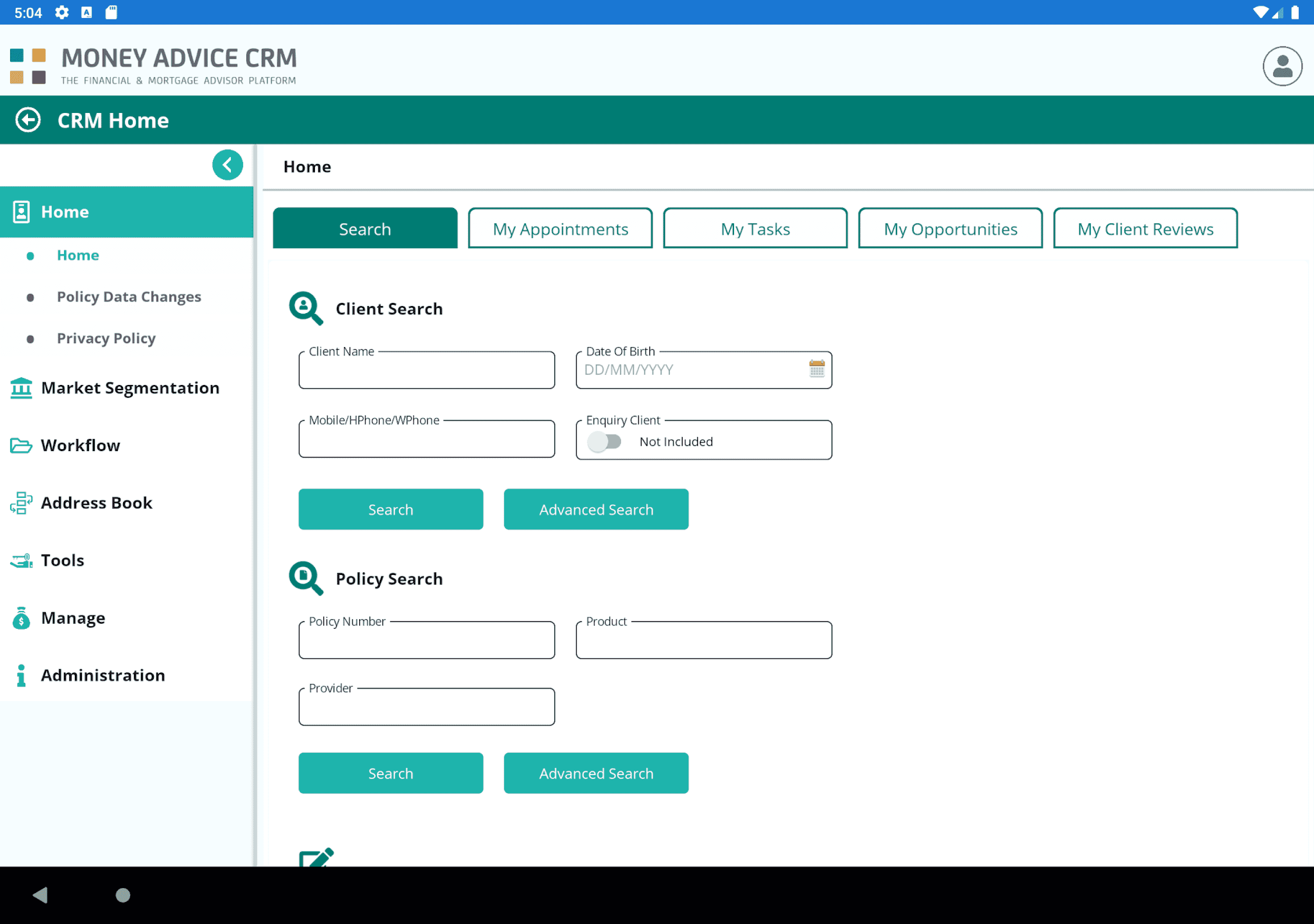

9. Money Advice + CRM – Best for Client Data Capture & Financial Tools

Image Source: Money Advice

Money Advice CRM was designed with mortgage and financial advisors in mind, and I noticed that immediately. It came with built-in calculators for affordability, protection quotes, and compliance checks, which were a huge time-saver during client onboarding.

What impressed me most was its remote access. I could pull up client files, generate mortgage quotes, and review financial reports on my tablet while visiting clients. This flexibility really fits the hybrid workstyle that most advisors live in today.

On the downside, setup took longer than expected because of the custom configurations required. Still, once it was up and running, it gave me deeper financial insights than most CRMs I’ve tried.

Pros:

- Provides integrated mortgage solutions with direct access and regular updates.

- Provides thorough client data collection and needs analysis with built-in financial calculators.

- Enables advisors to generate detailed protection and mortgage quotes with automated data entry.

- Ensures system and client information access from any device for effective remote work.

Cons:

- Steeper learning curve in setup.

- Support can be slow during peak times.

User Ratings: 4.1/5

Pricing:

Custom pricing.

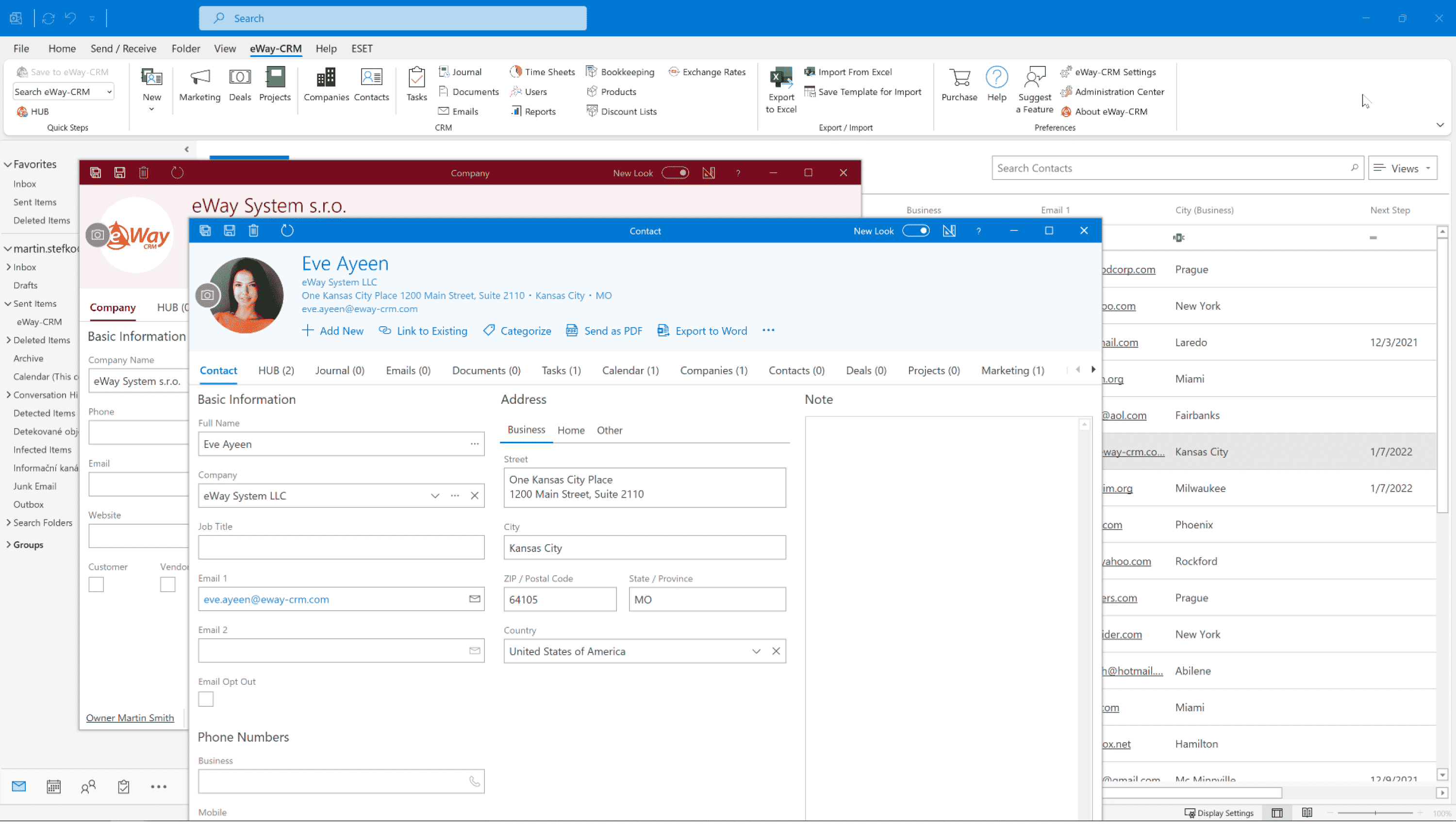

10. eWay-CRM – Best for Outlook-Based CRM Integration

Image Source: eWay CRM

Since most of my advisory communication happens over email, I loved how eWay-CRM turned my Outlook inbox into a CRM. I didn’t need to learn a new interface — everything from logging calls to tracking deals happened inside Outlook.

It also gave me peace of mind with its cloud storage and GDPR-ready features. I could attach compliance docs, track interactions, and manage reminders directly in the system without switching tools.

The mobile app wasn’t perfect, and occasional Outlook bugs were frustrating. But if your firm already lives in Outlook/Microsoft 365, this CRM fits like a glove.

Pros:

- Integrates with Outlook for easy client management directly from your inbox.

- Offers a mobile app that syncs contacts and provides access to essential data on your phone.

- Allows customization of fields and steps to align with your company’s processes.

- Includes comprehensive GDPR features for stringent data privacy compliance.

Cons:

- Custom filters are restricted to certain predefined fields, limiting detailed data sorting.

- Occasional bugs due to integration with MS Outlook are affecting overall system stability.

User Ratings: 4/5

Pricing:

Starts at $18/user/month.

My Top 3 Picks for Financial Advisor CRMs

To make the choice easier, I’ve narrowed it down to my top three picks and why I believe they stand out:

Option 1 – BIGContacts

BIGContacts is simple, affordable, and perfect for small to mid-sized advisory firms. It handles contact management, reminders, email follow-ups, and even invoicing. With a free plan and user-friendly setup, it’s easy for teams to adopt daily. A great no-frills choice for organizing client relationships without complexity.

Option 2 – Redtail CRM

Redtail CRM is built specifically for financial advisors, offering householding, portfolio integrations, and compliance-ready note tracking. It connects seamlessly with advisor tools like planning software and custodians. Affordable and widely used, it’s reliable for both solo advisors and large teams, though its interface feels dated. A strong industry-standard option.

Option 3 – Wealthbox CRM

Wealthbox stands out with a modern, intuitive design that even non-tech users adopt quickly. It includes workflow templates, a collaborative activity stream, and integrates with many third-party apps. While not the most advanced, it balances usability, security, and efficiency—ideal for independent advisors and small firms wanting a clean, approachable CRM.

Evaluation Criteria

I scored each CRM using six simple lenses:

- User reviews: What real advisors say on G2 and Capterra, plus recurring pros/cons.

- Features: How well it handles contacts, automation, reporting, and any standout AI or compliance tools.

- Ease of use: Interface clarity, setup time, and how quickly a team can adopt it.

- Support: Quality of onboarding help, response times, and depth of tutorials/resources.

- Value for money: Features and outcomes compared to price across tiers.

- My hands-on take: Practical insights from using each tool, plus expert viewpoints where useful.

This keeps the comparison focused on real performance and fit for financial advisory work, not just marketing claims.

How to Choose the Right CRM for Financial Advisors

Before you commit to any CRM, here are a few key questions and considerations to guide your decision:

1. Will this keep me compliant?

Pick a CRM that auto-logs emails, calls, meetings, and creates audit trails. Look for WORM-style storage, immutable notes, and communication reports. Ask about text archiving and change tracking on records. Finance-specific CRMs should make audits faster and reduce risk under FINRA and SEC rules.

2. How easy is data migration?

Avoid painful imports. You need clean CSV imports, field mapping, and duplicate checks. Ask if the vendor helps with migration and provides templates. Do a small test import first, validate key fields, then scale up. A smooth migration saves weeks of cleanup and prevents data loss.

3. Does it handle real advisor relationships?

Advisors manage households, spouses, dependents, COIs, and multiple accounts. Choose a CRM that supports householding, linked contacts, lifecycle stages, and account-level history. You should see an entire family and professional network in one view and record interactions at the person, household, and account levels.

4. Can it handle my email outreach?

Your CRM should support segmented bulk emails, templates, and scheduling without strict daily caps. It must integrate with Outlook or Gmail to auto-log messages. Confirm deliverability practices and unsubscribe handling. If you send newsletters to 500+ contacts, ensure limits, throttling, and spam controls won’t block you.

5. What’s the learning curve for my team?

A great CRM gets used. Favor clean interfaces, quick onboarding, and clear tutorials. Run a trial with your team to check comfort and speed. If adoption requires months of training or big workflow changes, it will stall. A simpler tool that everyone uses beats complex software nobody opens.

6. Will it integrate with my stack?

List must-have tools: planning (eMoney, MoneyGuide), portfolio (Orion, Morningstar), risk (Riskalyze), custodians, calendar, and email. Choose a CRM with native integrations or an open API and reliable connectors. Tight integrations prevent double entry, keep data current, and make your CRM the hub for daily work.

CRM Setup & Migration Process

Switching to a new CRM can feel overwhelming, but breaking it down into steps can make the process a lot smoother. Here’s a simple checklist I recommend following to ensure your CRM migration is clean and stress-free:

1. Export and clean data

Pull contacts and client info from your old system (Excel, Outlook, or CRM) and fix it before importing. Remove duplicates, standardize formats, and double-check email/phone fields. Cleaning now prevents errors and messy records later.

2. Map financial fields

Plan how key details like portfolios, risk scores, and household relationships will move into the new CRM. Use custom fields or mapping tools to place data correctly. Proper mapping ensures client birthdays, AUM, and linked contacts land where they should.

3. Integrate tools early

Right after migration, connect your CRM with email, calendar, and core financial tools (e.g., planning, portfolio, custodian systems). Set up Gmail/Outlook syncing and brokerage integrations immediately. This makes the CRM a central hub and avoids double entry.

4. Build templates and workflows

Draft common templates such as new client welcome, review reminders, or holiday messages. Set up workflows for onboarding or post-meeting follow-ups. If you’re under compliance rules, get approval before using. Doing this upfront keeps communication consistent.

5. Train your team

Show staff how to log calls, create tasks, and update records. Walk them through using workflows and templates. Hands-on practice with mock clients helps them build habits. A short training now saves confusion later and boosts adoption.

6. Test with a pilot group

Start with 5–10 clients or one advisor’s book before going firmwide. Test email sends, task reminders, and data accuracy. Fix issues in this phase, then roll out fully. A pilot prevents big mistakes and builds team confidence in the new system.

Choose the Right CRM for All Your Financial Advisory Needs

Choosing the right CRM isn’t about picking the flashiest tool, it’s about finding one that fits how you work. The best option will support compliance, simplify client management, and scale as your practice grows — saving you from switching systems later.

A well-chosen CRM can give you back hours each week by automating tasks, organizing client data, and keeping workflows smooth. Firms that fully adopt these tools often see measurable gains in efficiency and growth because they spend less time on admin and more time with clients.When testing CRMs, look for ease of setup, intuitive features, and reporting that actually helps you. Some platforms even offer free plans for growing businesses like BIGContacts making it easier for growing advisory firms to try a solution long-term without heavy upfront costs.

Frequently Asked Questions

How much does a CRM for financial advisors cost?

Costs vary widely: entry-level advisor CRMs start around $8–$50 per user/month; mid-tier can go to $100+; enterprise systems may exceed $300/user/month. Also factor in setup, add-ons, and integration fees.

How long does CRM adoption typically take for a financial advisory firm?

Adoption usually takes 2–8 weeks depending on team size, data complexity, and training. A phased rollout (pilot first) helps. Ongoing support, clear workflows, and accountability ensure steady use. Don’t expect 100% adoption on day one — it’s a gradual shift.

Does a CRM reduce compliance risk for financial advisors?

Yes. A good CRM logs communications (emails, calls, notes), retains audit trails, timestamps changes, and secures documents. This ensures you're ready for audits or regulatory reviews. But compliance is only safe if the team consistently uses the CRM correctly.

How do I migrate data from Excel, Outlook, or old CRM systems?

Export your data, clean duplicates and format it, then map fields (e.g., “AUM,” “DOB”) into the new CRM. Test with a small dataset first. Many vendors assist or offer migration tools. Proper mapping and cleanup upfront reduce errors and save time later.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!